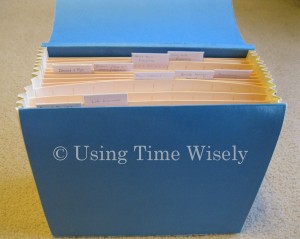

[1]Last week I began explaining my life insurance policies, consisting of three bundles kept in the third file opening of Box 2 of our important documents [2].

[1]Last week I began explaining my life insurance policies, consisting of three bundles kept in the third file opening of Box 2 of our important documents [2].

In Part 1, I shared the paperwork associated with my term life insurance policy [3]. These items are paper clipped together in the first bundle.

The second bundle is my combination life insurance and long-term care insurance policy.

Combination Life Insurance and Long-term Care Insurance Policy

Just like Paul’s policy [4], this combination insurance operates as an extra life insurance policy. If I need in-home care, then I can act on the long-term care benefits of this policy. Currently, this policy has a low overall value. However, we choose to slowly increase the value at each annual or open enrollment. By adjusting slowly, we increase our coverage without a significant increase in cost.

This policy obtained through Paul’s work belongs to me. If Paul leaves his job, we will lose the payroll deduction benefit, and pay the premiums directly to our insurance provider. Knowing that we own this policy, we choose to invest in our future without reservation because a job change will not cancel these benefits.

The documents kept in this bundle include the following:

1. Change notifications. Choosing to automatically increase the value each year, we receive notification of the new premium amount, new face value, and the date of the change. These documents are kept in my file near the policy.

2. Endorsements. Confirmation of additions or changes of riders on the policy is given via an endorsement notice. Occasionally, the insurance company offers new riders to existing customers. If we choose to add these riders (e.g., accidental death benefit, accelerated death rider, EZ value benefit rider, etc.), then the insurance company will check the request. Once approved, I will get a letter listing the changes and effective dates. These notices are kept together near the policy for verification of coverage.

3. Beneficiary Designations. Documentation verifying my beneficiary designations and any changes made to those designations stay in the file with the policy.

4. Policy. This multi-paged document, detailing the insurance contract, stays in this file.

5. Application for insurance. Though this group policy did not require a physical exam, I answered some general health questions with my application during an annual or open enrollment session. After completing the electronic application, we retained a copy.

The application information went to the insurance company, and coverage began after approval. Though my policy is active, I choose to keep the application documentation in this file.

Paper clipped together, these documents stay behind the term life insurance documentation bundle in this third file opening.

Though this combination policy seems insignificant now, it can save our financial future. Long-term care policies are very expensive, but locking in at a young age will save money in the long run. As our policy value and premium slowly increase each year, we hope to have comfortable coverage in our old age.

After researching and obtaining these insurance policies, I keep them safe within my filing system. As you discover a system that works for you, keep it current. In the event you need these items, you will want to have accurate information that is easily accessible. Keep up the great organizing!

Question: What types of life insurance policies do you find beneficial for your family?