With the increase in contribution limits for 2012 [2], consumers have more options as they plan for retirement.

In working through our important documents, I took the time during this retirement category to explain the options through an overview [3], the types of accounts [4], allocating your money [5], designating your beneficiaries [6], and transferring your accounts [7].

In completing this category, I will share how to invest in multiple plans and list the retirement documents held within my File Box 3 [8].

Investing in Multiple Plans

If you have money to invest for retirement, then you will want to get the most from your contributions. Remember, you will need to part with your money and not touch it until retirement.

If you think you will need that money before retirement, then consider a money market fund [9] – which acts like a savings account with a higher return for your investment.

When you determine that you can put this money aside without touching it until retirement, then invest as follows:

1. Employer-sponsored Plan – the maximum one can contribute in 2012 is the lesser of one’s entire income or up to $50,000 which includes any matching by the employer. For 401(k) and 403(b) plans, employee contribution limits are $17,000.

2. IRA or Roth IRA – the maximum is $5,000 per person. You may split your contribution between your Traditional IRA and Roth IRA, but the total cannot exceed $5,000 in your individual retirement accounts.

3. Annuities – if you have invested in the prior two options or a self-employment option and still need a retirement account, then invest in annuities. Remember, annuities are not tax-free, so choose wisely.

Filing Retirement Documents

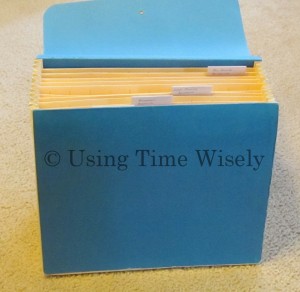

Within File Box 3 [8], I have filed our social security documents [10] in the first file opening. In the second and third slots, I have our retirement documents. The second slot holds Paul’s retirement documents while the third file opening holds my retirement documents.

Paul’s Retirement Documents

1. His employer-sponsored retirement plan documents include the summary description [11], quarterly statements, and beneficiary designations which are paper clipped together. If he had any withdrawals, then copies would also be kept within this bundle.

2. For his Roth IRA, the summary page, conversion documentation, quarterly statements, and beneficiary designations stay paper clipped together within this opening.

3. The final set of documents are copies of the check and account statement from the initial transfer from an employer-sponsored plan to a Traditional IRA.

These three sets of documents are housed in the second file opening of our File Box 3.

Tracy’s Retirement Documents

Behind the summary pages, I keep one set of documents for my Roth IRA. These documents include copies of the check from my employer-sponsored 401(k) plan when I rolled it over to a Traditional IRA, the quarterly statements, and beneficiary notifications.

This bundle also includes the transfer paperwork from a Traditional IRA to a Roth IRA and all the quarterly statements since the conversion. These documents remain paper clipped and housed in the third file opening of File Box 3.

Other documents you might have are correspondence, withdrawal slips, and merger documentation when one company combines with another.

Weekly Project: Separate your retirement documents by person and file them.

In using time wisely to organize your important documents, find a system that works for you. I share my documents as an example to follow. Adjust these recommendations to meet your needs.

In finishing up 2012, we have completed the second of five categories in File Box 3 [8]. Beginning in 2013, we will continue organizing the third category – our investment documents. Continue plugging along while using time wisely.

Question: What additional retirement documents do you have within your filing system?