Knowledge is freeing. Knowing where items are located, the balance in our accounts, and the dates of time-sensitive materials, we can make informed decisions knowing we have used all the tools available to gain that information.

Having completed the Planning for Success series last year [2], I did not feel tied to my calendar. In fact, I loved seeing all the details as I could easily move items around without forgetting anything.

I find planning eases my mind from having to remember everything. I don’t need to lie in bed wracking my brain to remember what I forgot to do.

As I continue Scheduling 2014, I am adding more items to my list. I have not completed all 5 items from the prior scheduling post [3], but I have jotted down the items I still need to record. My list includes a magazine subscription, a newspaper subscription, and 2 home warranty dates.

In addition to my list, I am adding monthly due dates, payday deposits, and credit report schedule and using the FREE printable to stay organized while using time wisely.

6. Mark Due Dates for Monthly Bills: Planning for Success – Day 5 [4]

Listing due dates a day or two prior to the actual date gives me a little leeway should I get behind on paying bills. Since I pay bills twice a month, I rarely get close to the due dates, but the buffer puts my mind at ease when crunch time comes.

In addition to our mortgage, utilities, tuition, and other monthly bills, I record paying my children an allowance. I discovered last year that we went 4 months without paying them simply because I forgot. From that point on, I have marked my calendar with the word “allowance” to remind me. It works as I haven’t forgotten since recording it on my calendar.

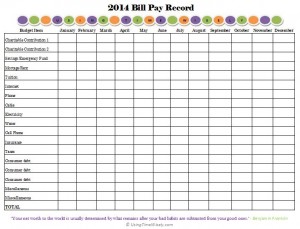

As I pay bills each month, I record the amounts on our bill pay record. Having included the FREE printable last year, I updated the record for you again this year. 😉

FREE PRINTABLE

Bill Pay Record – 2014 [5] (.pdf version)

Bill Pay Record – 2014 Excel version [6] (Microsoft Excel version)

You are welcome to download, customize with the Excel version, and use this FREE printable. To share this resource with others, please forward the link to this post [7] rather than sending the file directly.

Thank you for protecting Using Time Wisely’s copyright [8].

7. Post your Payday Schedule: Planning for Success – Day 19 [9]

Not only does posting the payday schedule let me know when money will arrive, but it also reminds me to check the pay stub. With Paul’s check getting automatically deposited and the pay stub available online, I must remember to check the online stub for accuracy.

Back in the day, the pay stub was sent via mail or interoffice envelope, but now the stubs are only available online. Mistakes happen. A co-worker of Paul’s learned the hard way when she discovered at the end of the year that her federal taxes had not been deducted. She never checked her stub and trusted that all was well. It was not, and she was left with a hefty tax bill.

To catch payroll errors, check your pay stub. Though I review after each pay period, you will want to scan your pay stub at a minimum of 3 times a year:

- After the first paycheck of 2014

- After the first paycheck of the start of your company’s fiscal year

- After any salary changes

8. Insert Credit Report Schedule: Planning for Success – Day 6 [10]

With the rise of identity theft, one needs to stay alert to unusual activity. One way to do so is to request your FREE credit report from each of the three credit bureaus on a rotating basis. If you were to request all 3 at the same time, then you will need to wait an entire year before checking again.

To watch our credit throughout the year, I request our reports on this schedule [11]. By seeing two different reports every 4 months, we will be able to identify any new or unauthorized accounts before any more damage is done.

Since I would forget without a reminder, I schedule to request this year’s reports a day later than the date on the current report. For example, if February 10, 2013 is the date on Paul’s Experian report, then I schedule to request his next Experian report on February 11, 2014. This way the report is FREE.

In scheduling 2014, the monthly due dates, payday deposits, and credit report schedule land on my calendar to free my mind from remembering these important tasks. As I seek using time wisely, I find a calendar with all the details a great tool.

If you live by your calendar, I hope these resources help you know what needs to be done to free you to using time wisely. Happy scheduling!

Question: How do you keep up with all the details of life?